To LLC or Not to LLC? A Guide for Short-Term Rental Owners

Is an LLC the right choice for your short-term rental? This legal guide breaks down the pros, cons, and simple…

Legal & Policy Contributor

I spent my early career clerking for a judge who handled zoning disputes and property cases, and that experience changed how I think about law entirely. Watching a single ordinance reshape a neighborhood made me realize how much the public needs someone translating this stuff into plain English. After a stint at a municipal law office drafting housing regulations, I found my way into legal journalism and never looked back. Now I track STR legislation from draft to enactment, parse court rulings, and try to explain what it all means for the people actually affected. I have a bit of a reputation for thoroughness (I read the meeting minutes, not just the ordinance) and for my footnotes, which started as a habit from my clerking days and are now apparently part of my brand. I believe informed communities make better laws, so whether you are a host navigating permit requirements or a neighbor trying to understand a new zoning rule, my goal is to make sure you walk away feeling like you actually get it.

Is an LLC the right choice for your short-term rental? This legal guide breaks down the pros, cons, and simple…

Airbnb’s push for federal reform of short-term rental regulations aims to shape the rules that govern hosts, investors, and affordable…

Major U.S. cities have enacted new short-term rental regulations for 2024, including tougher licensing, rental day caps, and data-sharing requirements—transforming…

Short-term rental regulations are shifting rapidly as Airbnb and similar platforms take an active role in political advocacy, raising the…

Thinking of starting a short-term rental in Canyon Lake, Texas? Before you list your property, you need to know that…

Pittsfield, Massachusetts is finalizing short-term rental rules, including caps on the number of properties one person can own and limiting…

The recently passed "One Big Beautiful Bill Act" has permanently restored 100% bonus depreciation, creating a massive tax-saving opportunity for…

The Short-Term Rental (STR) loophole is a powerful tax strategy that can save investors thousands by allowing them to deduct…

Juneau’s STR task force proposes allowing multiple short-term rentals per dwelling and offers a grandfathering period for existing operators, but…

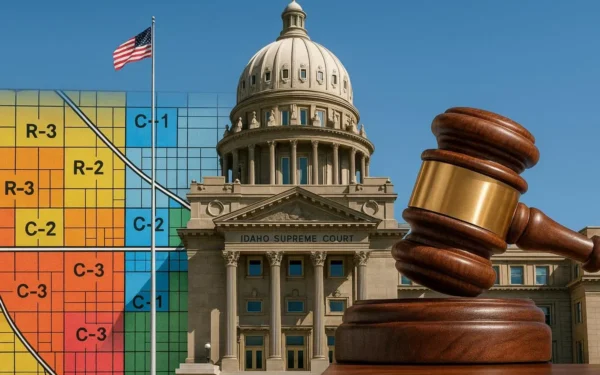

The Idaho Supreme Court's unanimous ruling overturning Lava Hot Springs' ban on non-owner-occupied STRs marks a legal sea change. State…

Take a look at our sister companies

Create your account to start analyzing properties

Analyze properties, track investments, and grow your short-term rental portfolio

Join 2,500+ STR investors getting weekly insights

We typically respond within 24 hours

Select a plan to get started with StaySTRA

3 property analyses per month • Basic STR metrics • Email support

Unlimited property analyses • Advanced STR metrics • Save & compare properties • Print reports

Everything in Pro Monthly • Best value - equivalent to 2 months free • Priority support