Building Your Direct Booking Channel: The Data Behind Reducing OTA Dependence

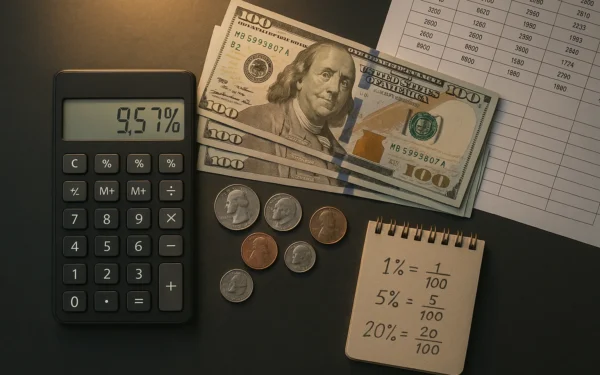

Direct bookings generate up to 30% higher profit margins than OTA reservations. Here is the fee-by-fee breakdown, the billboard effect…

Senior Data Analyst & Research Editor

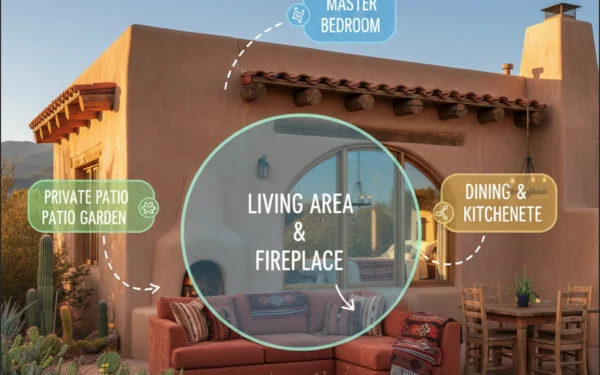

I started my career as a government statistician, spending years buried in housing and tourism datasets before moving into private-sector market research. That work taught me something important: behind every spreadsheet is a human story waiting to be told clearly. Eventually I found my way to the short-term rental industry, and it turned out to be the perfect intersection of everything I care about, data, housing, communities, and the way they all connect. As Research Editor here, I dig into rental market trends, regulatory impacts, and the real numbers behind the headlines. If a city says its new ordinance improved housing availability, I'm the one checking that claim against actual inventory data. I believe good analysis should feel accessible, not intimidating, so I try to write the way I'd explain something to a smart friend over coffee. I'm based in Santa Fe, where my desk is covered in Pueblo pottery and there's always a fresh mug of black coffee within reach.

Direct bookings generate up to 30% higher profit margins than OTA reservations. Here is the fee-by-fee breakdown, the billboard effect…

From Port Arthur to the Hill Country, StaySTRA data reveals which Texas markets deliver the strongest STR returns heading into…

Airbnb’s fee structure changed in late 2025, and most US hosts have not finished doing the math. Here is a…

The short-term rental market has reset. Supply hit 1.7M properties, occupancy normalized at 55%, and winners are separating from losers.…

The numbers are in for FIFA World Cup 2026. From 1,900%+ booking surges to $5,700 per host projections, here's what…

San Antonio's STR market grew 116% over 10 years to 8,597 active listings. Current data shows $178.42 ADR, 60% average…

Learn how to use the "Lego Strategy" of Cost Segregation to unlock massive tax savings on your Airbnb or Vrbo.…

Texas property taxes can create obstacles for traditional financing. This guide reviews the top 10 DSCR lenders in Texas, analyzing…

Key Takeaways Are you a highly compensated doctor or lawyer struggling with a heavy W-2 tax burden? Buy Property Purchase…

Explore the growing market of short-term rentals in small cities, uncovering trends, statistics, and insights for investors and travelers.

Take a look at our sister companies

Create your account to start analyzing properties

Analyze properties, track investments, and grow your short-term rental portfolio

Join 2,500+ STR investors getting weekly insights

We typically respond within 24 hours

Select a plan to get started with StaySTRA

3 property analyses per month • Basic STR metrics • Email support

Unlimited property analyses • Advanced STR metrics • Save & compare properties • Print reports

Everything in Pro Monthly • Best value - equivalent to 2 months free • Priority support