New York Short-Term Rentals: Investor Prospects by the Empire State Building

Looking to expand your portfolio with New York short-term rentals? From the Metropolitan Museum of Art to vibrant festivals like SummerStage, NYC offers investors access to world-class attractions and a constant flow of guests. As regulations and tourist flows shift, STR investing in New York continues to offer unique advantages and challenges.

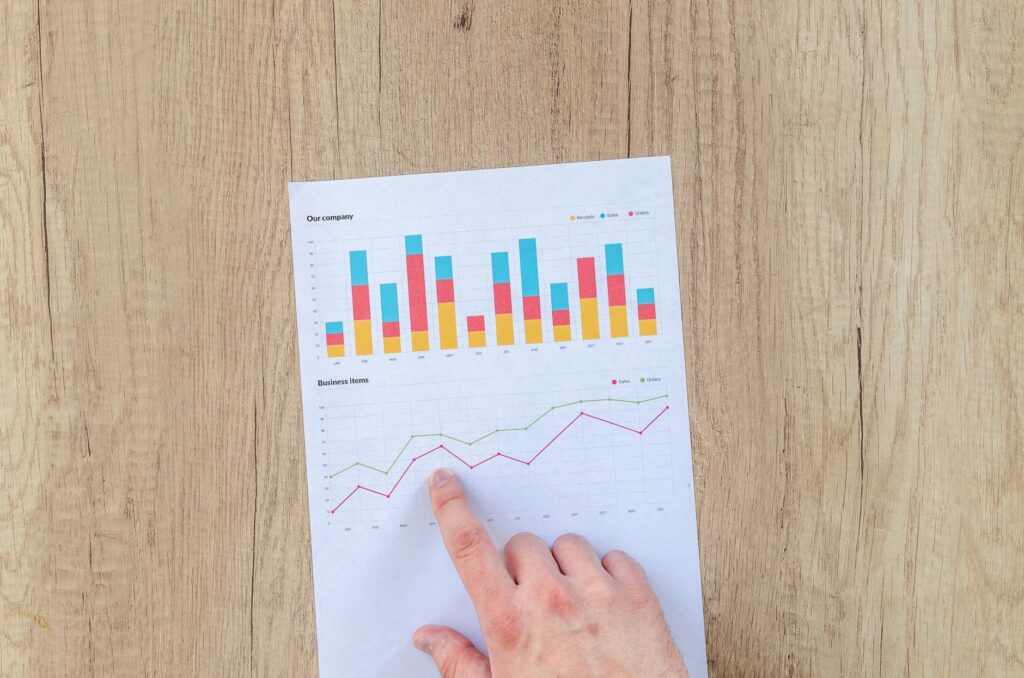

Quick Takeaways:

- Over 37,000 active vacation rental listings in New York

- Average Daily Rate (ADR) hovers near $250 as of April 2025

- Occupancy rates steady at 78% citywide

- Year-over-year STR revenue up 6%, despite regulation changes

- Most cancellations linked to guest preference, not local laws

- Tip: Focus on properties near major attractions or transit hubs

Market Supply and Regulation

New York’s short-term rental supply adapts as local rules change. Despite stricter registration laws, hosts stay active by prioritizing legal multi-family homes or 30+ day stays. Investors targeting compliant buildings can avoid income interruptions and tap into consistent demand near attractions like the Museum of Modern Art. STR regulations drive innovation, requiring strategic property selection.

Booking Trends & Guest Preferences

Travelers seek unique stays close to city highlights. Bookings peak during spring and major NYC events, while cancellation rates remain low. Properties offering flexible stays attract both tourists and business travelers, helping to maintain high occupancy even in off-peak months. Diversified booking strategies maximize returns for vacation rentals in New York.

Revenue Drivers in 2025

Year-to-date, average daily rates have climbed as new inventory tightens. Premium amenities and standout locations—such as Lower Manhattan or near Central Park—yield the highest returns. Targeting festivals or peak tourism windows boosts profitability. Aligning investment timing with major city happenings secures reliable revenue growth for STR investing in New York.

StaySTRa Analyzer

If you’re evaluating a specific property or narrowing your investment focus, the StaySTRa Analyzer lets you plug in an address and see actual STR performance data. It’s free to use and built for investors.

Long-Term Outlook & Investor Tips

Despite regulatory transitions, New York’s short-term rental market offers ongoing potential. Leveraging smart technology and property management tools mitigates operational risks. Local partnerships—like with arts organizations or universities—help sustain bookings. To further explore opportunities, visit the official Airbnb New York directory, check out local landmarks like the Whitney Museum of American Art, or plan around the Tribeca Film Festival.

Bottom Line:

Strong demand for vacation rentals in New York, steady occupancy, and rising ADR position the city as a solid long-term play. Turn regulatory shifts into advantage with careful property choice and stay data-driven.