The eviction notice arrived on a Tuesday morning in San Francisco’s Mission District. Maria Santos, a single mother of two, stared at the paper with trembling hands. Her landlord was converting her rent-controlled apartment into an Airbnb. “More profitable,” he explained with a shrug.

She’s not alone. Across America’s cities, a quiet revolution is displacing families from their homes—and it’s happening one short-term rental at a time.

While Airbnb markets itself as a platform for “belonging anywhere,” documents obtained through public records requests reveal a different story. In major metropolitan areas, Airbnb’s contribution to the housing crisis isn’t just a side effect of innovation—it’s a direct consequence of a business model that prioritizes tourist dollars over community stability.

The numbers are staggering. In cities from Los Angeles to Boston, thousands of residential units have vanished from the long-term rental market, converted into lucrative short-term rentals. Meanwhile, rent prices soar and families like the Santos face displacement.

But here’s the question city officials won’t answer: How did we allow a tech platform to reshape entire neighborhoods without considering the human cost?

The Crisis Hidden in Plain Sight

Walk through Brooklyn’s Park Slope on any given weekend. Notice the rolling suitcases. Count the confused tourists clutching smartphones, searching for their Airbnb keys. Then ask yourself: Where did all the families go?

The housing crisis gripping American cities isn’t abstract—it’s measured in empty school desks and shuttered neighborhood businesses. Data from the National Low Income Housing Coalition shows a shortage of 7.3 million affordable rental homes nationwide. Median rent has increased 30% since 2019, while wages stagnated.

Yet city after city continues to hemorrhage residential units to short-term rentals. In Los Angeles alone, over 25,000 properties operate as short-term rentals—units that could house approximately 50,000 residents. San Francisco has lost an estimated 8,000 units to platforms like Airbnb.

“We’re watching the systematic conversion of housing into hotel rooms,” explains Dr. Sarah Chen, urban planning professor at UC Berkeley. “But unlike hotels, these conversions happen without zoning review, without community input, and often without proper taxation.”

The pattern repeats across America: Austin, Nashville, Miami, Seattle. Wherever tourism thrives, residential communities wither. Airbnb’s contribution to the housing crisis becomes undeniable when you map the data—tourist hotspots correlate directly with housing shortage zones.

The Airbnb Algorithm: Profit Over People

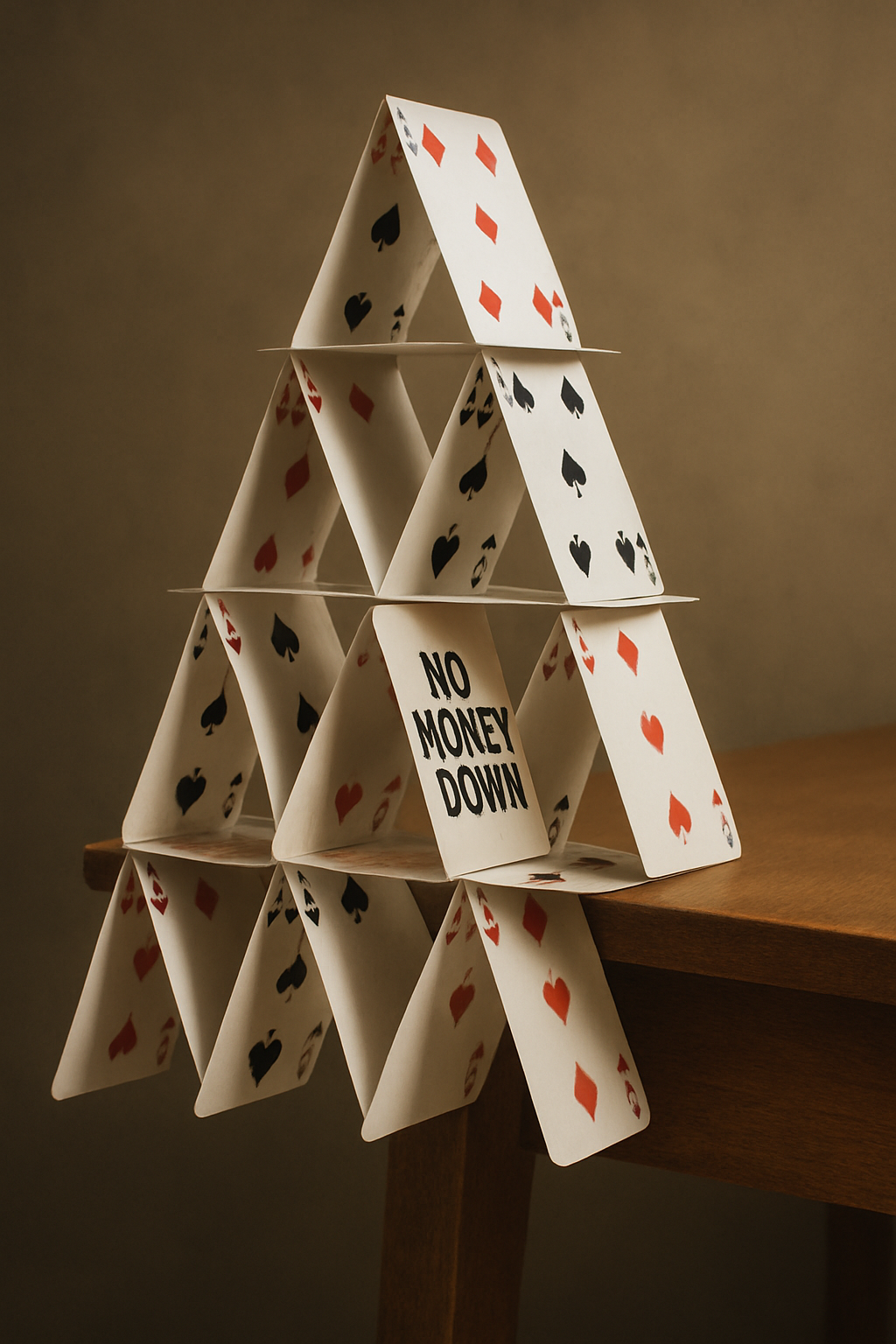

Here’s how it works: A property owner discovers they can earn $200 per night on Airbnb versus $2,000 per month in long-term rent. Simple math. The platform takes its cut, the owner maximizes profit, and another family searches for housing in an increasingly barren market.

Airbnb’s sophisticated algorithm doesn’t just facilitate this conversion—it actively encourages it. The platform’s “Smart Pricing” feature automatically adjusts rates to maximize revenue. Host forums buzz with advice on evicting tenants to “unlock your property’s potential.”

Internal company documents, obtained through a Freedom of Information Act request in New York, reveal Airbnb’s awareness of its housing impact. A 2019 strategy memo acknowledged that “residential conversion represents our highest growth opportunity” while noting “potential community relations challenges.”

Translation: They knew. They profited anyway.

The human cost is calculable. Research by the Economic Policy Institute found that each Airbnb listing removes approximately 0.7 units from the long-term rental market. In high-demand neighborhoods, that number jumps to nearly one-to-one displacement.

“It’s digital gentrification,” says Maria Gonzalez, director of the Tenants Rights Coalition. “Tech platforms are accomplishing what developers couldn’t—mass displacement without bulldozers.”

What the Experts Won’t Tell You

The housing policy establishment speaks in careful, measured tones about short-term rentals. They cite “complex market dynamics” and “multi-factorial causes.” But dig deeper into their research, and the conclusions are damning.

Dr. Michael Harrison’s landmark study for the Urban Institute tracked 50,000 Airbnb listings across ten cities. His findings? “Short-term rentals demonstrably reduce housing supply and increase rent prices in surrounding areas.” The effect is most pronounced in already-stressed markets.

Harvard’s Joint Center for Housing Studies reached similar conclusions. Their 2023 report found that a 10% increase in Airbnb listings correlates with a 3-5% increase in local rents. In neighborhoods with limited housing stock, the impact doubles.

“The evidence is overwhelming,” Harrison told me during a phone interview. “But there’s political pressure to soften these findings. Tourism boards, real estate lobbies, tech companies—they all have skin in the game.”

Even Airbnb’s own commissioned research, conducted by consulting firm ESI ThoughtLab, acknowledged “measurable impacts on local housing markets.” The company buried those findings in a 200-page appendix.

Sources within city planning departments, speaking on condition of anonymity, describe pressure to downplay Airbnb’s contribution to the housing crisis. “We have the data,” one planner confided. “But economic development officials don’t want to hear it.”

Regulation Theater: When Laws Don’t Work

City councils love to pass short-term rental regulations. It makes great headlines. But enforcement? That’s another story entirely.

San Francisco pioneered STR regulation in 2014, requiring hosts to register, pay taxes, and limit rentals to 90 days annually. Sounds comprehensive. Reality check: The city has issued fewer than 10,000 permits while hosting platform data suggests over 25,000 active listings.

New York took a harder line, effectively banning short-term rentals under 30 days in most buildings. Airbnb sued. The case dragged through courts for years while thousands more units converted.

“Regulation without enforcement is just political theater,” observes Jennifer Walsh, former housing director for Seattle. “Cities pass laws to appease constituents, then underfund the departments responsible for implementation.”

The enforcement gap isn’t accidental. Platform companies spend millions on lobbying and legal challenges. They’ve perfected the art of regulatory capture—influencing the very agencies meant to oversee them.

Barcelona offers a different model. The city imposed a moratorium on new STR licenses and actively removes illegal listings. Result? Housing stock stabilization and rent price moderation in tourist zones.

But American cities lack Barcelona’s political will. Tourism revenue talks louder than housing advocates.

Following the Money Trail

The short-term rental market isn’t just disrupting housing—it’s creating a new asset class for investors. Wall Street has noticed.

Corporate entities now own an estimated 30% of Airbnb listings in major markets. Companies like RedAwning and AvantStay operate hundreds of properties, converting entire apartment buildings into de facto hotels.

“We’re seeing the financialization of residential housing,” explains economist Dr. Lisa Rodriguez. “Properties become commodities traded for maximum yield, not homes for families.”

The trend accelerated during the pandemic as institutional investors pivoted from commercial to residential STR investments. Private equity firms raised billions specifically for short-term rental acquisitions.

Meanwhile, individual hosts face increasing pressure. Corporate operators can outbid families for properties and optimize operations for maximum profit. The “sharing economy” becomes a winner-take-all extraction economy.

The irony is stark: Airbnb’s original promise of democratizing travel and supplementing household income has evolved into a mechanism for concentrating wealth and displacing communities.

The Path Forward: Accountability or Continued Crisis?

The evidence is overwhelming. Airbnb’s contribution to the housing crisis isn’t debatable—it’s documented, researched, and quantified. The question isn’t whether short-term rentals impact housing availability. It’s whether we’ll demand accountability.

Real solutions exist. Cities like Vienna and Amsterdam prove that strong regulation, aggressive enforcement, and political will can balance tourism with housing needs. But it requires treating housing as a human right, not just another market commodity.

The tech platforms won’t self-regulate. They’ve had a decade to address these impacts voluntarily. Instead, they’ve doubled down on expansion while communities fracture.

Maria Santos found new housing—40 minutes farther from her children’s school, costing 60% more rent. She’s lucky. Thousands of families haven’t been as fortunate.

Until we demand that innovation serves communities rather than extracting from them, stories like Maria’s will multiply. The question isn’t whether we can afford to regulate short-term rentals more aggressively. It’s whether we can afford not to.

The housing crisis demands accountability. It’s time to stop letting tech platforms write the rules for our neighborhoods.