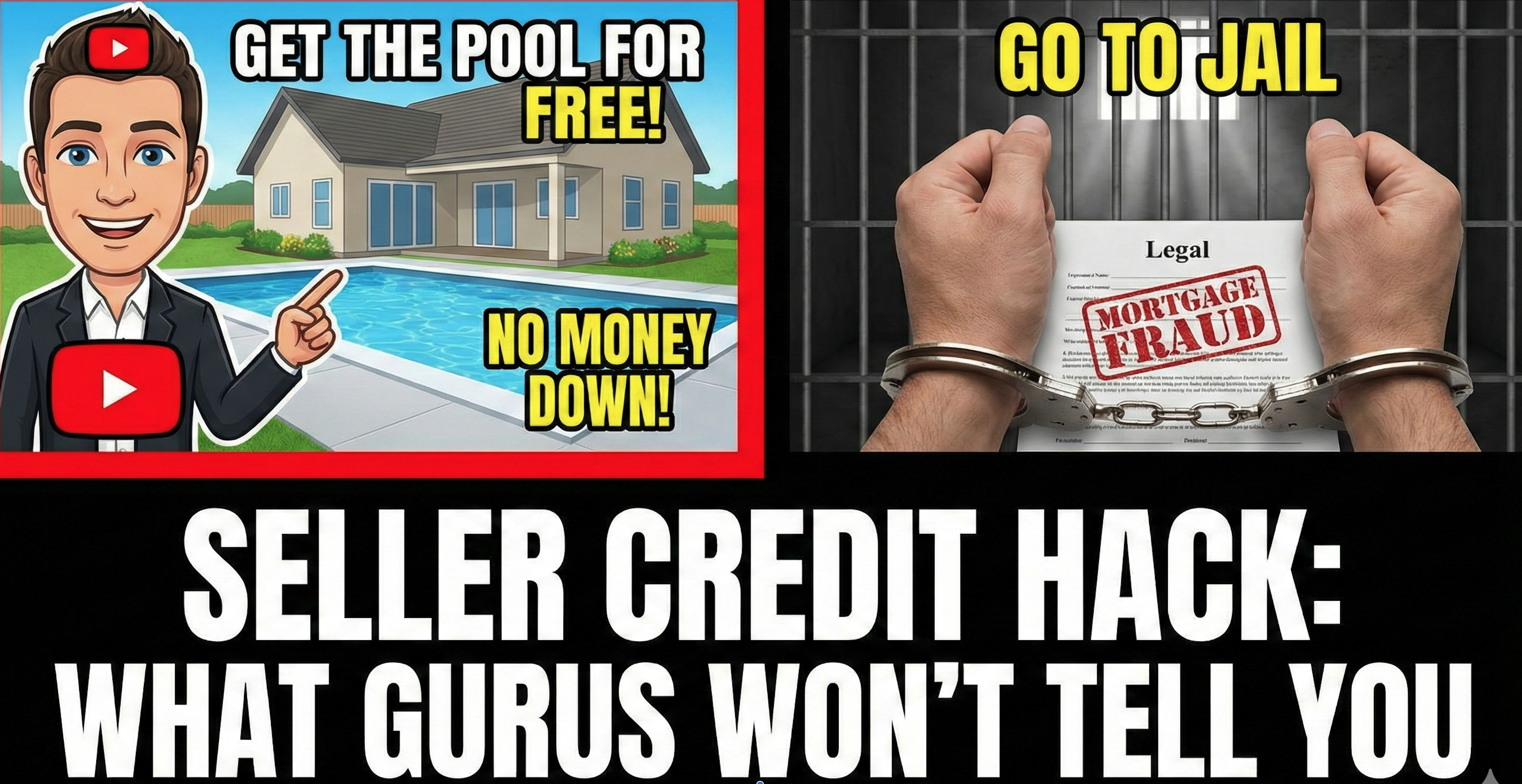

You’ve seen the video. A real estate “guru” stands in front of a whiteboard and tells you how to buy a house with zero money down and get the seller to pay for a new pool.

They call it “creative financing.” In the world of conforming loans (Fannie Mae/Freddie Mac), the FBI calls it mortgage fraud.

This is a sophisticated issue sitting at the intersection of deal-structuring and federal crimes. If a deal structure cannot survive the scrutiny of an underwriter seeing every single penny move, you are walking into a trap.

Here is the truth about “Interested Party Contributions,” the risks of the “Pool Strategy,” and the legal workarounds that actually get deals closed.

The Trap: Why the “Pool Strategy” is Fraud

Here is the scenario the influencers pitch: You offer $550k on a $500k house. You ask the seller to credit $50k to a contractor at closing to build a luxury pool.

If you do this on a standard conforming loan, here is why it’s illegal:

- The Appraisal is Vaporware: The appraiser values the home at $550k based on the contract. But the actual collateral is worth $500k. That extra $50k value doesn’t exist yet.

- LTV Manipulation: Lenders base the Loan-to-Value (LTV) on the lower of the purchase price or appraisal. By inflating the price to include future work, you are borrowing against air.

- The Kickback: If that $50k payment happens off the settlement statement (HUD/ALTA)—or is labeled vaguely—it is an undisclosed kickback. That is bank fraud.

The Golden Rule: Full disclosure is the antidote to fraud. If you can’t show it to the underwriter, you can’t do it.

The Reality: Interested Party Contributions (IPCs)

Fannie Mae and Freddie Mac have strict rules for what they call “Interested Party Contributions” (IPCs). This covers seller credits, realtor credits, and builder incentives.

You can only use IPCs for:

- Closing Costs (Title, recording fees, transfer taxes).

- Prepaids (Escrow funding for taxes and insurance).

- Discount Points (Buying down the rate).

You cannot use IPCs for:

- Down payments.

- Cash back to the buyer.

- Capital improvements (pools, roofs, renovations).

Know Your Limits (Or Lose the Money)

Even if you use the credit legally for closing costs, there is a hard cap on how much the seller can give you. If the credit exceeds these limits, the lender will simply deduct the excess from the sales price. You lose that money.

IPC Limits for Conforming Loans:

| Occupancy Type | LTV (Loan to Value) | Max Seller Credit |

| Investment Property | All LTVs | 2% |

| Principal / Second Home | > 90% | 3% |

| Principal / Second Home | 75.01% – 90% | 6% |

| Principal / Second Home | ≤ 75% | 9% |

The STR Trap: Most Short-Term Rentals are purchased as Investment Properties. That means your cap is 2%. On a $500k purchase, that is $10k. That barely covers title and prepaids; it certainly isn’t building a pool.

Note: Many buyers claim “Second Home” status to get the higher 9% limit. If you intend to rent it out full-time on Airbnb, claiming it as a second home is Occupancy Fraud. Don’t do it.

The “White Hat” Alternatives (How to Actually Do It)

If you need to wrap renovation costs into the loan, stop trying to hack a standard mortgage. Use the products designed for it.

1. The Fannie Mae HomeStyle® Renovation Loan

This is the legal way to execute the YouTube strategy.

- How it works: The lender lends based on the “As-Completed” value (ARV).

- The Mechanics: Contractor bids are submitted to the lender before closing. The extra money goes into a custodial escrow account managed by the lender.

- The Verdict: 100% legal. It allows for pools and ADUs, but requires approved contractors and more paperwork.

2. The Cash Preservation Strategy

Use the seller credit strictly for closing costs and rate buydowns (up to the 2% cap).

- The Strategy: If the seller covers your $10k in closing costs, that is $10k of your cash that stays in your pocket.

- The Result: You use your saved cash to fund the renovations after closing. No fraud, no headaches.

3. Seller Completes Work Pre-Closing

If the seller is motivated, they can hire the contractor and pay for the work before title transfers.

- The Risk: The seller spends money on a house they might not sell if your financing falls through.

- The Mechanics: You write an amendment stating the seller will complete specific improvements prior to closing. The appraiser re-inspects. The value is real, so the loan is valid.

The Bottom Line

There is a difference between creative deal-structuring and a federal indictment.

If a seller credit strategy relies on the lender “not noticing” where the money went, walk away. Stick to the IPC limits, use Renovation Loans for big projects, and keep your business strictly above board. The ROI on a good STR is high enough that you don’t need to cheat to win.