Asheville Short-Term Rental Regulations: Permits, Zoning, and the 2026 Rules Hosts Must Follow

Asheville bans whole-home STRs in most zones. Here is what the homestay permit actually requires, how taxes stack to 16.75%,…

Legal & Policy Contributor

I spent my early career clerking for a judge who handled zoning disputes and property cases, and that experience changed how I think about law entirely. Watching a single ordinance reshape a neighborhood made me realize how much the public needs someone translating this stuff into plain English. After a stint at a municipal law office drafting housing regulations, I found my way into legal journalism and never looked back. Now I track STR legislation from draft to enactment, parse court rulings, and try to explain what it all means for the people actually affected. I have a bit of a reputation for thoroughness (I read the meeting minutes, not just the ordinance) and for my footnotes, which started as a habit from my clerking days and are now apparently part of my brand. I believe informed communities make better laws, so whether you are a host navigating permit requirements or a neighbor trying to understand a new zoning rule, my goal is to make sure you walk away feeling like you actually get it.

Asheville bans whole-home STRs in most zones. Here is what the homestay permit actually requires, how taxes stack to 16.75%,…

Savannah's STVR rules are among the most detailed in Georgia. Learn the permit types, cap system, tax obligations, and enforcement…

Miami and Miami Beach operate under entirely different short-term rental rules. Miami Beach's $20,000 starting fine is not a typo.…

Arizona's short-term rental regulatory landscape has changed dramatically since the 2016 preemption law. Here is what Scottsdale Airbnb and VRBO…

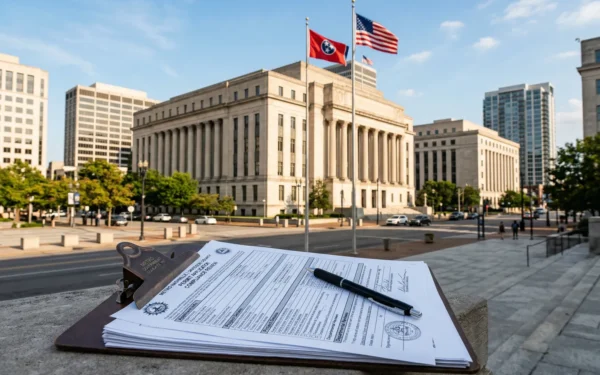

Nashville's STR rules are detailed, strictly enforced, and full of zoning distinctions that can catch investors off guard. Here is…

Houston's first comprehensive STR ordinance took effect January 1, 2026. Registration, $1M liability insurance, human trafficking training, and fines up…

Austin's updated STR ordinance hits platforms on July 1, 2026. License display requirements, delist enforcement, and occupancy limits mean hosts…

The One Big Beautiful Bill Act permanently restored 100% bonus depreciation for STR property acquired after January 19, 2025. Here…

California SB 346 brings platform accountability. Rhode Island doubled STR taxes. Austin requires license numbers by July 1. The EU…

The FIFA World Cup 2026 kicks off in four months. Here's a city-by-city breakdown of STR permits, tax obligations, and…

Take a look at our sister companies

Create your account to start analyzing properties

Analyze properties, track investments, and grow your short-term rental portfolio

Join 2,500+ STR investors getting weekly insights

We typically respond within 24 hours

Select a plan to get started with StaySTRA

3 property analyses per month • Basic STR metrics • Email support

Unlimited property analyses • Advanced STR metrics • Save & compare properties • Print reports

Everything in Pro Monthly • Best value - equivalent to 2 months free • Priority support